Fundamentals drove cotton prices down to the mid-70s before selling ran out of steam and a small bit of demand brought prices back to the high 70s for old crop and the mid-70s for new crop. July found its support at 77 cents but slipped lower before recapturing the 78-cent mark, settling the week at 78.06. Likewise, December searched out its support at the 74-cent mark and settled the week at 75.97

Read MoreUSDA’s Commodity Credit Corporation has announced the 2024 crop loan rate differentials for upland and extra-long staple cotton

The differentials, also referred to as loan rate premiums and discounts, were calculated based on market valuations of various cotton quality factors for the prior three years. This calculation procedure is identical to that used in past years.

Read MoreLow prices have encouraged export sales of all growths and U.S. cotton continues to move. Yet the level of sales is not sufficient to suggest that demand is improving. In fact, the level of sales does not even suggest any improvement in demand. Thus, cotton prices remain trapped within the narrow six cent, 77-83 cent trading range. The high 70s to low 80s trading range for both old crop and new crop will continue to prevail.

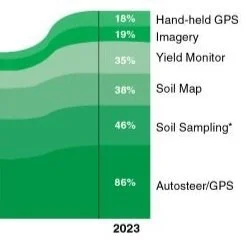

Read MoreOne of Cotton Incorporated’s missions is to improve cotton production profitability through research. To make sure our research direction is addressing current challenges, and that past research results have had a positive impact, Natural Resource Surveys of U.S. cotton producers were conducted in 2008, 2015, and 2023.

Read MoreThe U.S. Department of Agriculture’s (USDA) Commodity Credit Corporation today announced the 2024 crop loan rate differentials for upland and extra-long staple cotton.

The differentials, also referred to as loan rate premiums and discounts, were calculated based on market valuations of various cotton quality factors for the prior three years. This calculation procedure is identical to that used in past years.

Read MoreFaced with the potential of a dicamba-free growing season, farmers across the country reevaluated their dependence on a long-time, highly effective herbicide tool. No class of farmers was more wary than cotton growers, whose yield relies on more intensive management with fewer effective herbicide options than any other dicamba-friendly crop.

Read MoreMy best cotton friend in Lubbock says the market is going higher while my best buddy in Memphis says it’s going lower. Of course, I agree with my friends.

Read MoreIn mid-December, the ICE May’24 climbed from 80 cents, peaking over 96 cents in February before settling back at its current level in the lower 90s. Similarly, the July’23 contract peaked over a dollar before retreating back to the lower 90s.

Is the old crop rally in cotton futures over? Maybe. Maybe not. Does it matter much to growers? Well, that depends.

Read MoreAccording to Dow Jones' survey of market analysts, USDA is expected to announce 92.0 million acres of corn plantings in 2024, down from 94.6 million acres in 2023. For soybeans, 86.3 million acres are expected to be planted in 2024, up from 83.6 million acres in 2023.

Read MoreThe U.S. Cotton Trust Protocol is introducing an expanded field-level team dedicated to providing regional support for U.S. cotton growers participating in the voluntary sustainability initiative. This includes aiding producers with finalizing Trust Protocol enrollment and data entry as well as applications for the Climate Smart Cotton Program by the April 30 midnight deadline.

Read MoreThe ever-evolving framework of ag technology provides near-limitless resources for farmers looking to improve their efficiency and production down to a finite level – that is, if they can figure out how to work the darn stuff. And, even for students of the land educated beyond the school of hard knocks a father or father figure could provide, the pool of resources is just deep and dark enough to sink rather than swim.

Self-proclaimed “tech nerd” and Louisiana farmer Mead Hardwick of Hardwick Planting Co. has integrated a series of up-and-coming technologies on-farm over the years, starting with a family foundation.

Read MoreWith lower commodity prices and high input costs, growers will face difficult economic decisions in 2024.

Current cotton-to-corn and cotton-to-soybean price ratios are more favorable this year, but these prices may not be high enough to cover all production expenses. Given the financial pressures across the industry, the importance of a strong safety net cannot be overstated.

Read MoreThe WASDE’s March outlook for 2023/24 U.S. corn remains relative to last month. The season-average corn price for producers has been lowered to $4.75 per bushel based on observed prices to date.

The outlook for U.S. soybean supply and use for 2023/24 also remains unchanged for March. While soybean crush is unchanged, the soybean meal extraction rate has been bumped up slightly, and soybean meal exports are mostly higher due to lower domestic use. The U.S. season-average soybean price forecast stays unchanged at $12.65 per bushel.

Read MoreThe old crop May and July futures contracts will continue to have bullish activity at least through early June. The market will come under pressure if speculators instigate short covering selloffs, but the low 90s should prevent any activity below 90-91 cents – at least through the expiration of the May contract and into early June for the July contract. The only other bearish activity facing old crop will continue to be weak fundamental demand.

Read MoreSince it was launched in 1970 in response to increased market dominance from polyester and other synthetic fibers that threatened to put U.S. cotton out of business, Cotton Incorporated has told the story of U.S. cotton to brands, retailers and consumers. As a natural fiber, cotton is the natural choice.

Read More